Dear Culver City: $20 Million Is More Than We Can Afford

EDITOR'S NOTE: This piece was submitted by a source unaffiliated with Culver Crescent and does not represent the opinion of The Crescent or its writers.

EDITOR'S NOTE: This piece and others in the "Dear Culver City" series are editorial pieces submitted by sources unaffiliated with Culver Crescent. The sentiments expressed in these articles do not represent or confirm the stance or opinions of Culver Crescent or any of its writers.

By Dan O'Brien

I am writing to discuss the upcoming city budget vote on June 9 and to respond to letters published here. These letters inaccurately frame the $20 million loan appropriation to Community Corp. of Santa Monica (Community Corp.) as having a minimal impact on our General Fund, particularly our City’s Contingency Reserve Fund (aka Emergency Reserve).

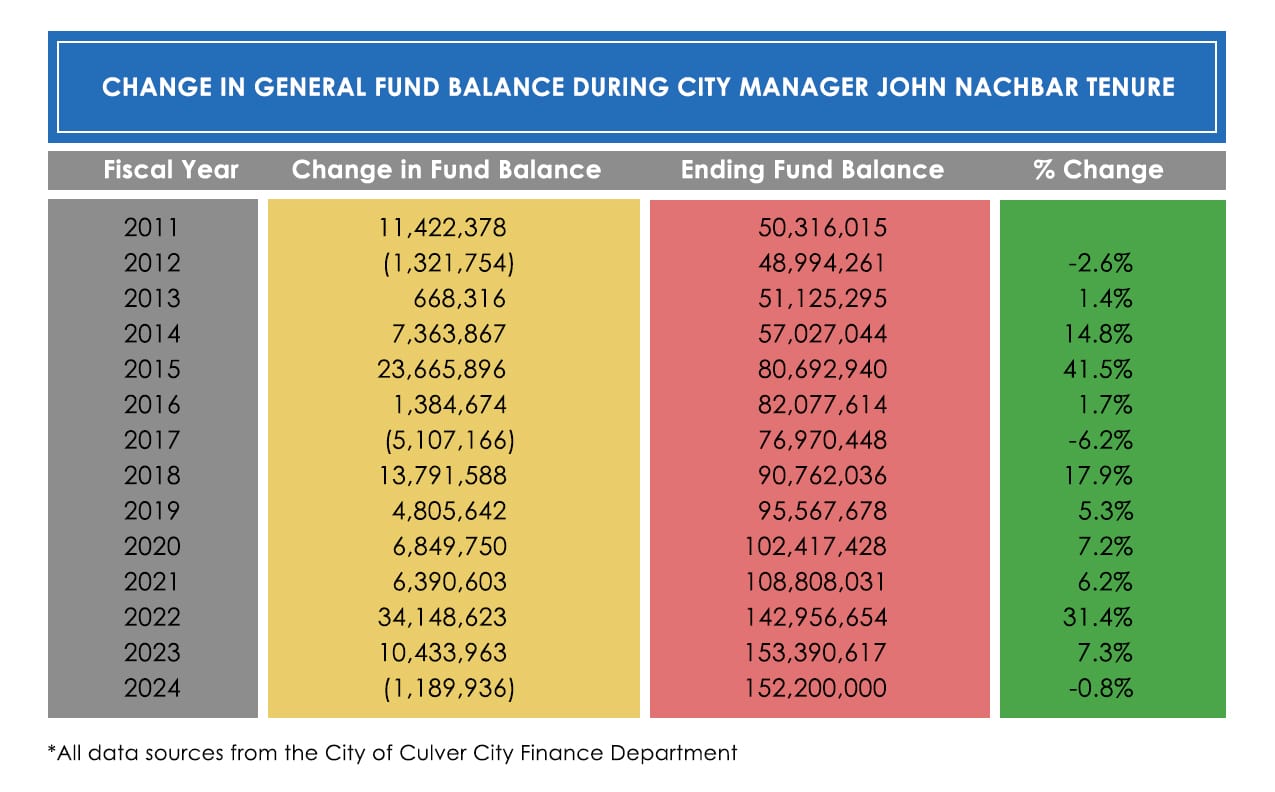

One letter from Nancy Barba states that in Culver City, “a chronic imbalance between revenues and expenditures dates back at least to 2010.” The facts tell a different story:

Since City Manager John Nachbar’s appointment in 2010, Culver City has successfully navigated numerous economic challenges — including the Great Recession, the statewide elimination of redevelopment agencies, the pension funding crisis, and the COVID-19 pandemic.

As the above chart shows, the City has tripled its General Fund balance while minimizing major losses during even the most difficult periods under his leadership.

Another grossly inaccurate statement in Barba's letter was, “Jubilo Village…is not draining emergency reserves. Of the $20 million identified for the project, a significant portion comes from legally restricted funds that must be spent on affordable housing.”

The facts tell a different story. Let’s break down the $20 million:

- $4 million loan from the Housing Authority Fund in 2022

- Dispersal is controlled by a 2024 Commitment Letter between the City and Community Corp., which requires, among other commitments, Community Corp. to close on construction financing, begin construction, and submit receipts for reimbursement.

- $16 million loan over the next two fiscal years

- First installment during FY25/26 for $4 million

- $2 million from the Housing Authority Fund

- $1,557,080 from the Affordable Housing Linkage Fee fund

- $442,920 from the General Fund.

- Second installment during FY26/27 for $12 million

- $12 million will be moved in FY25/26 from the General Fund Contingency Reserve to a Committed General Fund Reserve, which is anticipated to be distributed in FY26/27.

- This $12 million comes from the General Fund Contingency Reserve, which is part of the General Fund and is not legally restricted to affordable housing.

- $12 million will be moved in FY25/26 from the General Fund Contingency Reserve to a Committed General Fund Reserve, which is anticipated to be distributed in FY26/27.

- First installment during FY25/26 for $4 million

In summary, only $1,557,080 of the $20 million is restricted to affordable housing. The $6 million from the Housing Authority Fund can and is spent on things other than affordable housing, such as the City’s Rental Assistance Program (RAP), Mortgage Assistance Program (MAP), homeless outreach and services, and Housing and Human Services Department Administration.

In fact, the $6 million commitment depletes the Housing Authority Fund, thereby shifting $1.75 million in costs for these programs to the General Fund in FY 25/26. The General Fund will need to assume those costs on an ongoing basis now that the Housing Authority Fund is depleted.

The remaining $12 million General Fund Contingency Reserve and $442,920 General Fund expenses are both General Fund and not restricted to affordable housing, placing additional pressure on our ability to sustain basic city services to the level we expect.

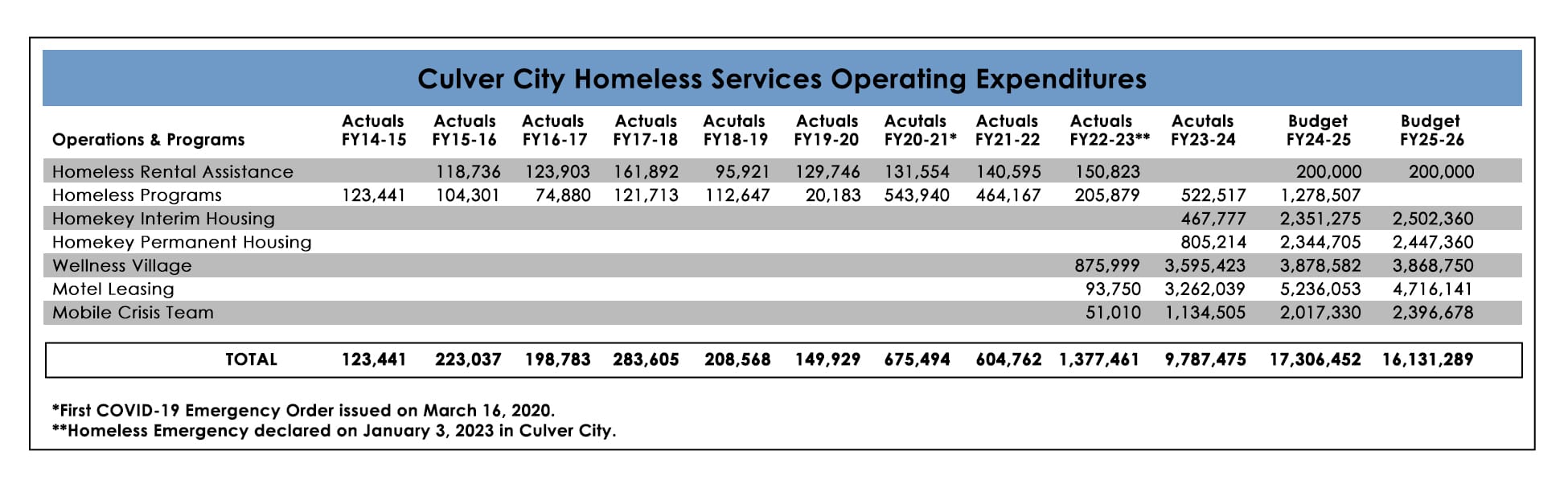

It’s critical to emphasize that Culver City already invests substantial resources in affordable housing. When I ran for City Council, the issue I heard most often from residents was the growing concern over our unhoused population.

At the time, we relied heavily on the limited and often ineffective services provided by Los Angeles County. In response, we brought many of these efforts in-house — and the results have been significant. From 2022 to 2024, Culver City saw a 66% reduction in its unsheltered homeless population.

However, a review of our historical spending on these services clearly illustrates the significant impact this new commitment has on our budget:

It is virtually unheard of for a city of our size to assume this level of responsibility. Based on an analysis by our city staff in 2024, presented during a city council meeting, a very small percentage of cities provide just one of the services Culver City does, and no one provides all we do.

Across the nation, counties — not individual cities — are tasked with managing homeless services.

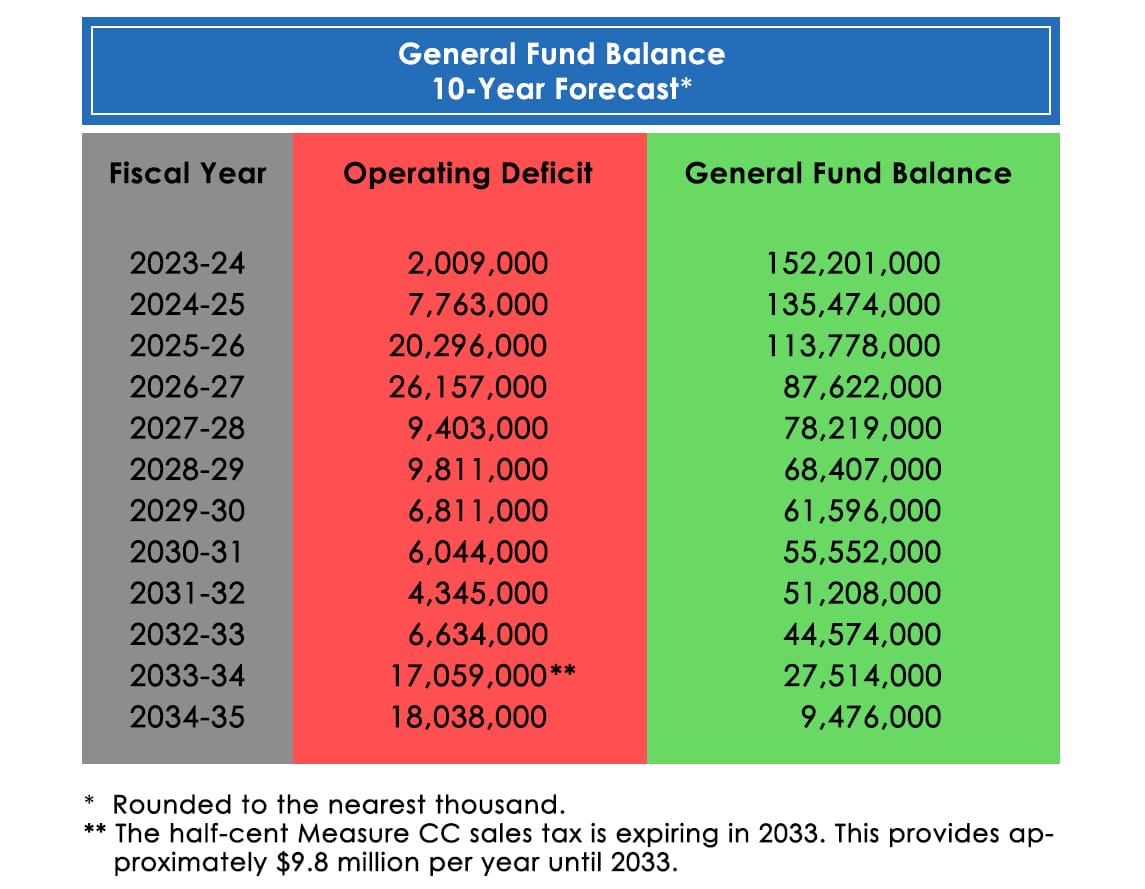

Notably, our deficit spending began in the same year we dramatically increased our commitment to these services. And according to our 10-year budget forecast, this financial strain is only projected to grow:

Our shrinking General Fund is why we cannot commit $20 million to the Jubilo Village project: we simply do not have the financial capacity. Culver City is currently operating at a deficit due in large part to our substantial and ongoing investments in housing and services for our unhoused population.

As outlined above, all but $1,577,080 of the proposed funding either comes directly from the General Fund or indirectly impacts it — by requiring other departments to draw from it after their original funding sources were depleted by this project.

In my opinion, this is the only thing to consider. Think of the many impactful projects the City could commit to for less than $20 million — projects that would improve our parks, sidewalks, and bike paths.

What if we used a fraction of this money for a robust rental assistance program?

What would an additional swimming pool cost? Far less than $20 million. We could spend $20 million on many things but cannot because we are operating under a structural deficit.

Candidly, I’ve spoken with other affordable housing developers across Los Angeles County, and they are surprised by the path we’re taking and the scale of financial commitment being considered. Jubilo Village was initially presented to the City Council with a reasonable request — a $2 million loan. That was manageable.

Then, the ask grew to $4 million. Now, it stands at $20 million — at the very moment we declared a fiscal emergency. This level of escalation is deeply concerning.

As an elected representative of Culver City residents, I have a responsibility to ensure that we make fiscally responsible decisions that protect our ability to provide essential services — such as safe and well-maintained streets, sidewalks, parks, and utilities; effective police and fire response; and a city hall that serves the public efficiently.

Committing $20 million to a single 93-unit affordable housing project would compromise that responsibility.

Dan O'Brien is the current Mayor of Culver City. He can be reached at dan.o'brien@culvercity.com or at (310) 850-1132.

Comments ()