Dear Culver City: The Concerns with Jubilo Village Project Financing

EDITOR'S NOTE: This piece was submitted by a source unaffiliated with Culver Crescent and does not represent the opinion of The Crescent or its writers.

EDITOR'S NOTE: This piece and others in the "Dear Culver City" series are editorial pieces submitted by sources unaffiliated with Culver Crescent. The sentiments expressed in these articles do not represent or confirm the stance or opinions of Culver Crescent or any of its writers.

By Gary M. Zeiss, Esq.

Listening to the March 27 city council meeting and the presentation by Community Corporation of Santa Monica (Community Corp.) Executive Director Tara Barauskas troubled me.

She reported that Community Corp. applied or will apply for funds from several sources to "supplant the $16 million that the city council directed staff to include in the upcoming two fiscal year budgets" (approximately 00:35:00 in the recorded session). Then, she went on to report the essential failure to secure any such funds.

These failures included:

- The unavailability of funds from the LA County Development Authority (LACDA) totaling $8.2 million, along with 42 housing vouchers, because such funds and vouchers are not available to projects that receive tax credits;

- The unavailability of funds from the California Department of Housing and Development (HCD) Homekey+, totaling $19 million, because such funds are not available to projects that receive tax credits;

- The waitlisting of the Project for 23 Section 811 vouchers; and

- The intent to apply for $20 million from HCD's Multifamily Housing Program, the award of which Community Corp. will not know until August.

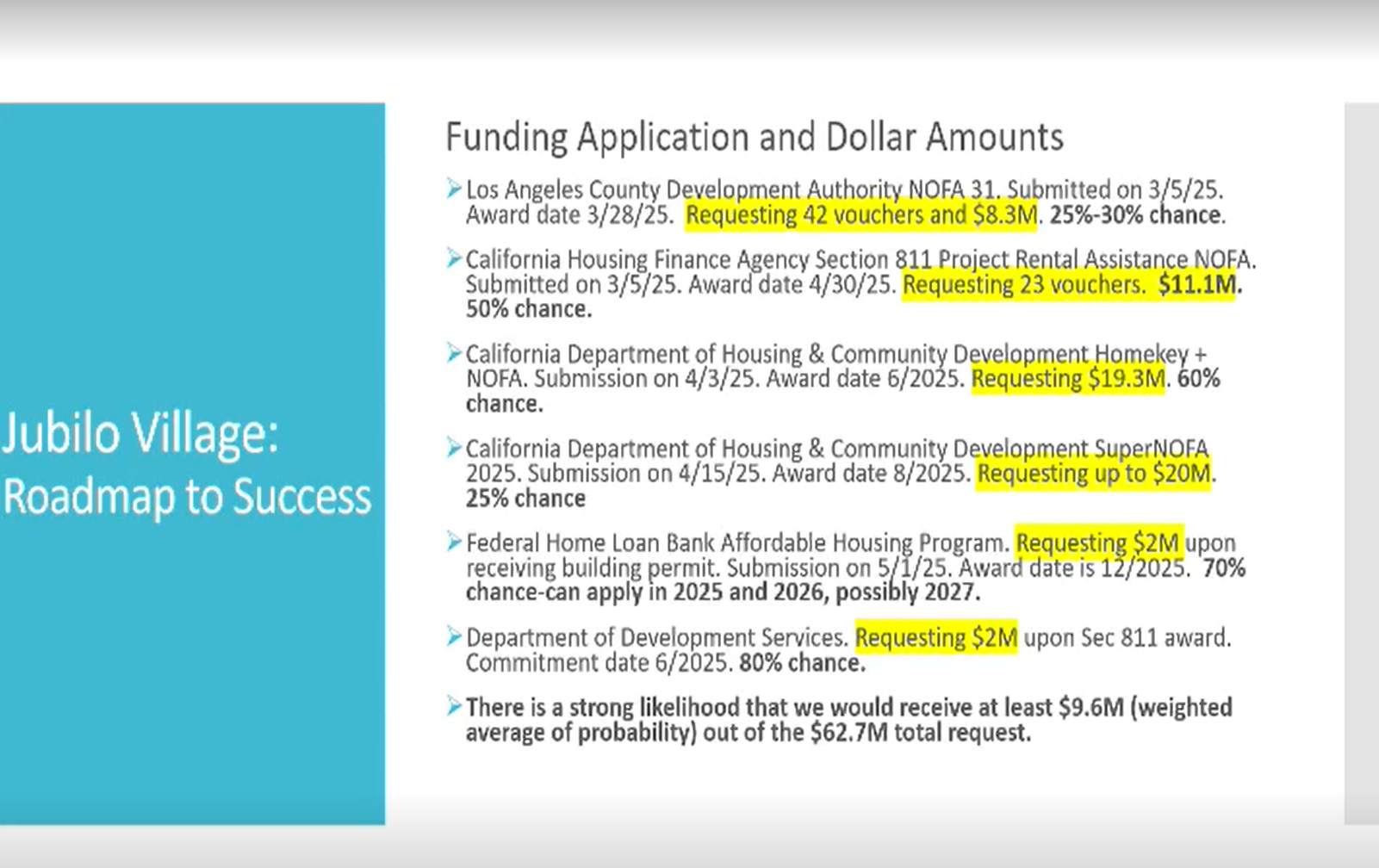

That reminded me of her presentation from March 10, 2025, which I reviewed, which contained the following slide (this can be found at approximately 1:14:00 into the meeting video):

The narrative given during the presentation of the table was the "unfortunate situation" regarding the $16 million shortfall. Community Corp. showed these funding sources as strategies to "overcome the shortfall," but her statement was clearly intended to lead the council and citizens to believe that disbursing the entire $16 million would not likely be necessary.

She then asserted that, given the likelihood of success, Community Corp. would get $9.6 million from these funds. The implication was either that should such funds be received, the full sum of the loans would not be necessary; or that these funds could be used to service the debt if Community Corp. received them.

Barauskas also stressed the importance of the timing of the city's commitment during that meeting because of the potential for expiration of the tax credits that may be available to Community Corp. (note, such credits do not benefit or lower the cost for Culver City, they benefit Community Corp.). However, the statements she made during the March 27 council meeting make it clear that if Community Corp. has tax credits available, two of the largest sources of funding — the LACDA $8.2 million plus 42 vouchers and the $19 million of Homekey+ funding — would not be available for the Project.

The HCD MHP funding is even more interesting. One would think that, should Community Corp. obtain a large sum from HCD MHP (they are seeking $20 million), that $20 million would be used to repay the loan to the city. At least, that was the implication. However, she did not state whether the tax credit would or would not compromise Community Corp.'s ability to obtain such funding, so I did some research.

The guidelines for HCD MHP funding can be found here. The good news (for Community Corp., at least) is that tax credits do not preclude HCD MHP funding. The bad news (for Culver City) can be found in Section 7307(a)(4), which states in relevant part:

(a) (4) When sizing the loan, the Department will consider all other available financing and assistance, including the full amount of any tax credit equity generated by the Project. In addition, the loan amount shall not exceed the total eligible costs required to do the following...with the exception of deferred Developer Fee, Department funds shall not be used to supplant other available financing, including funds committed by local jurisdictions.

This means that the HCD MHP funds cannot legally be used to repay the city for the $16 million loan. Her statement during the March 27 meeting that the listed funding sources would be used to "supplant the $16 million that the city council directed staff to include in the upcoming two fiscal year budgets" is materially false and misleading.

I am not a public financing attorney nor an expert in the field, but I found this section in about 20 minutes of research trying to learn more about the effect of tax credits. Frankly, it was not very difficult. It would be surprising if the exclusion of the other funding sources because of tax credits would have been substantially more difficult to find.

Barauskas was very clear that she and Community Corp. had substantial expertise in this field, having built several projects in Santa Monica with even greater city funding. In short, Barauskas knew or should have known about the aforementioned issues with funding, including the unavailability of major funding sources should tax credits be given, the limitations on the use of HCD MHP funds, and the effect of these issues on Community Corp's ability to supplant Culver City's prospective $16 million loan.

Remember, we are here now, with this illusory emergency request, because the loan was necessary to save Community Corp's tax credits (which paradoxically disqualifies it from significant sources of funding), not because it would have any positive effect on the city being able to get paid back for the loan.

In fact, the opposite is true.

One can only conclude that Community Corp. was either grossly negligent in their presentations regarding this funding or intentionally misrepresented this funding to the council and citizens of Culver City. Neither is acceptable and either is sufficient cause to immediately disqualify Community Corp. from any participation in the Jubilo Village project or any other project in Culver City.

Community Corp. is either lying outright to the council and the city or is woefully unqualified to do this Project. Those are the only reasonable conclusions that can be made.

I certainly hope that the council meet with Community Corp. on this matter forthwith and immediately remove Community Corp. from any participation in this and any other Culver City projects.

Gary M. Zeiss, Esq. is an attorney primarily dedicated to healthcare-related technology transactions who has been a Culver City resident since 2011. Zeiss lives in Clarkdale with his partner, Leo the ninja cat, and his stepson.

Comments ()