Diving into Culver City's 2025-26 Budget

Culver City's budget is set to be approved at next Monday's city council meeting. Here are five key takeaways from this year's document.

Culver City is preparing to approve the 2025-26 fiscal year budget on Monday, which will dictate spending from July 1, 2025 to June 30, 2026. This budget process has not come without its bumps in the road, from a push for more community input to an affordable housing project that has received both significant backlash and praise from that very community.

Here are some key takeaways from the budget made available to the public last month:

Personnel costs drive expenditure increase in largest city departments

Several council members have pushed for talks about finding cost-savings in Culver City, and these talks are sure to continue as the city's two largest departments — Culver City Police and Culver City Fire — saw 6.28% and 7.32% increases to their expenditure budget from the General Fund respectively.

However, a large portion of those costs are ingrained in the city's personnel and cannot be removed from the budget without cutting those people altogether.

Many of these costs are not employee salaries but other direct and indirect expenses tied to staffing. Among the largest percentage increases to a single line item in the entire General Fund budget is the Liability Reserve Charge for the Police Department's Operations Bureau. At just $942,026 last year, it ballooned more than three times to close to $3.5 million in the proposed 25-26 budget.

Unfunded retirement liabilities for employees are among the most taxing expenditures on the General Fund budget, with close to $17.9 million dedicated to covering this liability in the Police and Fire Departments alone.

Retaining staff also goes beyond paying their salaries and any overtime pay they may need. The city provides benefits to its employees that incur significant costs, including health insurance and workers' compensation. Other associated costs, such as the Federal Insurance Contributions Act (FICA) payroll taxes and paying into California disability insurance, also add to the financial burden of staffing.

This results in 79.4% of the Police's General Fund costs being directly tied to their personnel. Employee costs are an even greater burden on the city's second-largest Department by projected expenditures, with more than 87% of the Fire Department's General Fund spending connected to its staffing.

Jubilo Village burdens reserves, but impact on General Fund minimal

The $20 million the city is investing in the Jubilo Village project has been one of the hottest topics in Culver City, but even if the budget is approved on Monday, most of the money will still not have been spent.

Money disbursed in this fiscal year for the project comes from the following sources:

- Housing Authority Fund (Fund 476): $2,000,000

- Affordable Housing Linkage Fee (Fund 439): $1,557,080

- General Fund: $442,920

The $4 million that the city has already contributed to the project also came from the Housing Authority Fund, and the consequences of burdening it will show. The General Fund is taking on $1.75 million in expenditures for Housing and Human Department programs that the Housing Authority Fund, which the Jubilo Village payment has fully depleted, can no longer support.

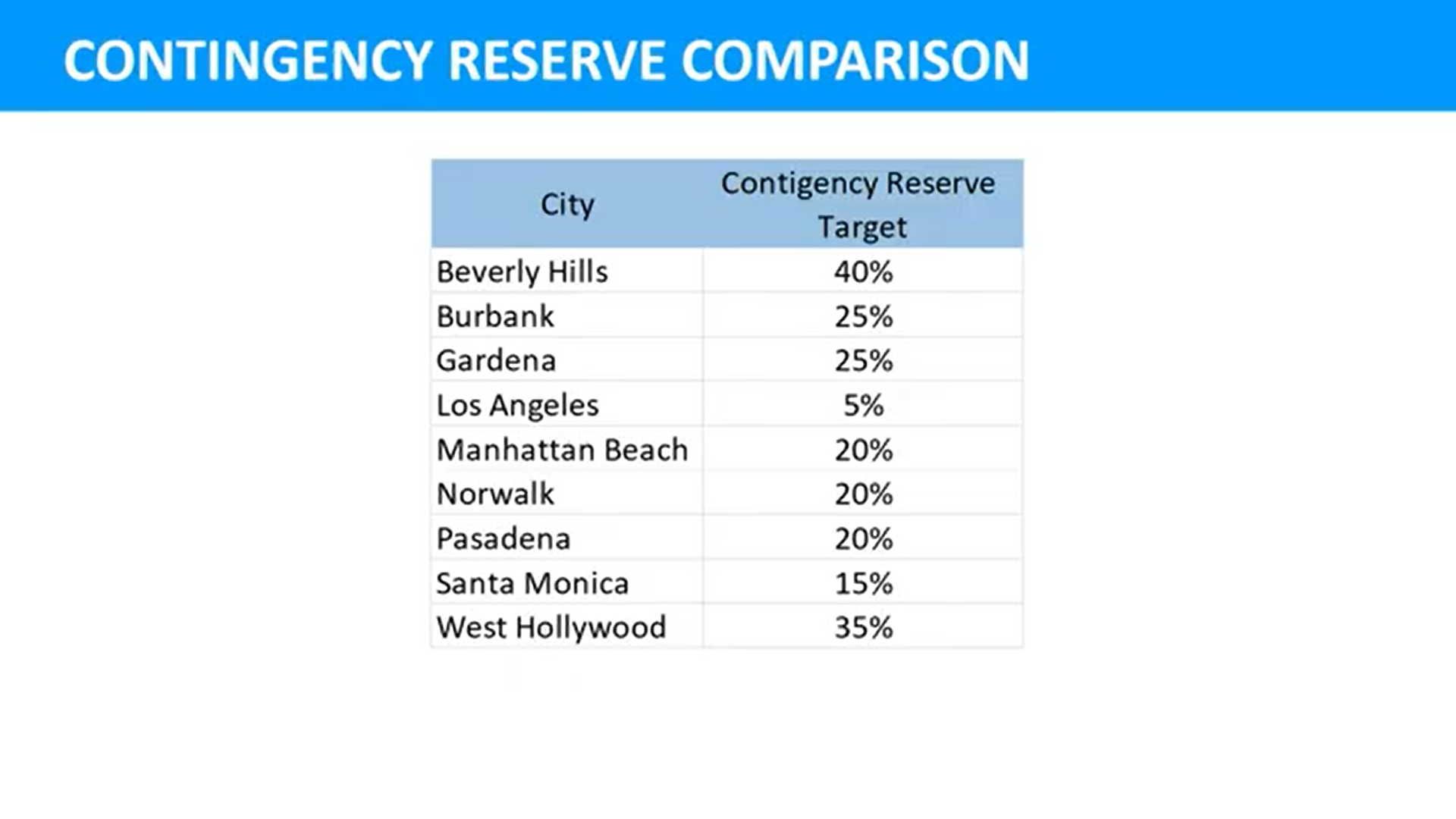

The remaining $12 million that the Council requested be set aside for the Jubilo Village payment in the 2026-27 fiscal year is held within the General Fund Contingency Reserve. While the money will not be disbursed this year, setting that money off-limits for general spending depletes the available contingency reserve to 21.6% of the city's General Fund revenue, well below the 30% target outlined in city policy.

Council Policy 5002 — last amended in June 2023 — outlines the city's financial policies, including the target threshold for the General Fund Contingency Reserve. The document does not specify a penalty or response, but the policy states that the City Manager should present a plan to replenish that reserve within five years.

When the annual budget surplus occurs while the contingency reserve does not meet its target threshold, all excess revenue is used to recover its losses. This replaces the regular budget supplementation that occurs during surplus years.

When there is a surplus, 10% of the amount is placed in the Public Safety Equipment Replacement Reserve, with a cap of $1 million. 40% of that remaining surplus is placed in the Facilities Planning Reserve, with the remainder reverting to Unassigned Fund Balance — money in the General Fund that is available to be allocated for use.

Measure CC Provides Preview of Potential Sales Tax Increase

Revenues continue to be strong as the country's recovery from the COVID-19 pandemic nears its conclusion, which is good news for the city and its most significant revenue sources.

Since implementing voter-approved Measure BL in 2023, the business license tax has become the second most robust stream of General Fund revenue for Culver City. The city received $31,650,000 from business license taxes, or almost 19% of its total $167,352,498 General Fund revenue in the 24-25 fiscal year.

Sales tax remains the city's largest source of General Fund money despite the state taking most of the 10.5% paid by shoppers in Culver City. This tax has been augmented by several voter-approved measures in past elections, one of which has its own revenue line item in the budget.

According to budget documents, Measure CC — the city's half-cent sales tax measure — brought in an estimated $16,611,000 in this fiscal year and is expected to generate $16,840,000 in the upcoming year. Combining this year's Measure CC dollars with the sales tax line item of $24,556,216, Culver City saw more than $41 million, or almost a quarter of its total General Fund revenue, come from sales tax in the 24-25 fiscal year.

At 0.5%, or one cent for every $2 spent, the Measure CC sales tax is set at twice the rate as the proposed sales tax increase that will appear in a special, all-mail election in late August. If that tax measure had been implemented for the 2024-25 fiscal year and added another $8,305,500 to the General Fund's 2024-25 revised total based, the deficit would have shrunk to a marginal $704,107.

Some business owners have argued that increasing the sales tax in the city will drive customers to shop elsewhere. If this prediction holds true, the impacts could be significant depending on how much sales tax receipts drop.

Here is what it might look like in the city dependent on how sales are impacted in Culver City by a new sales tax measure, based on the estimates from the last budget and the projections in this one:

Capital Projects spending slashed as city grapples with deficit

While General Fund spending is up, expenditures overall are down as the city looks to cut costs.

Capital Improvements represented about 6% of the city's spending in the 2024-25 budget, but that number has dropped to 1.6% in this proposed budget. However, the total from specialized funds has been increased overall, leading to a proposed $38.8 million in non-carryover spending in the Capital Improvement Plan this fiscal year.

City Manager John Nachbar has repeatedly noted that one of the first things a city should do during a fiscal emergency is cut back on capital expenditures, and this proposed budget reflects that philosophy.

Many funding sources for capital projects in Culver City are separate from the General Fund, including revenue received from Measure R, Measure M, and the Gas Tax. These funding sources — each with its own separate funds to hold excess money year-to-year — were heavily used last year to the tune of $50.3 million, much more than the $19.8 million estimated in the 24-25 adopted budget.

Less than $9.9 million is proposed to be spent from these Capital Funds in 2025-26, with many of the city's expenditures coming from projects whose funding was already set during a previous fiscal year and has carried over to the present day.

Some of the largest expenses in the Capital Improvement Plan are for maintaining the city's bus fleet and does not come out of the General Fund. Almost $5.5 million in the budget for bus replacements and $2.5 million for bus stop improvements are proposed for this year's budget out of the Municipal Bus Lines Fund.

Others have costs that come from funds that are not considered capital funds. The costs of planned building improvements like lighting enhancements at the Veterans Park fields come from the General Fund's Facility Planning Reserve, a committed piece of the General Fund available solely to maintain city facilities.

Some Capital Improvements are financed by uncommitted General Fund dollars even with these outside funds. Some examples of projects in the Capital Improvement Plan that come from the General Fund include support for technology in the council chambers, maintenance of the 405 Underpass, and maintenance of the infrastructure of Culver City parks.

However, the projects that use unreserved General Fund dollars this fiscal year are carryovers from previous budget allocations. While around $4 million was spent on capital projects from the unreserved General Fund last year, no new money is committed to capital work this year, with the $9.3 million in carryovers from last year covering the costs.

Housing Program cost increases projected to begin tapering off

Programs related to the unhoused population have been seen as significant drivers of recent spending in Culver City, but the cost escalation has dropped dramatically.

After allocating just $2,680,729 of the General Fund's budget for the Housing and Human Services Department in 2023, almost $11.4 million was allocated in the 24-25, and that number continues to grow.

While the 2025-26 proposed budget of $20,465,136 for the Department is less than the amount spent last year, it represents a 21.5% increase from the previously adopted budget.

Much of this cost increase comes from the recent push to improve services and shelter options for the city's unhoused population. Throughout various deliberations, members of the city council have generally agreed that the effort was necessary to help take unhoused residents off Culver City streets.

Unlike the Police and Fire Departments — whose costs are driven mainly by staff — the Department's expenses are primarily service-related, with much of the money tied to contractors that help maintain housing sites and programs.

Almost $11 million is dedicated to the city's Project Homekey sites and the Wellness Village alone, with another $4.7 million for contracted services for the unhoused population in the Housing Administration Division.

Among the largest adjustments to the Department's budget is the improvement of its Housing Protection services. After spending just $90,558 in 23-24, that number exploded to $4,560,005 and is proposed to increase again to $6 million this budget cycle. While this cost is daunting, it comes from money in the Culver City Housing Authority fund rather than the General Fund.

To view the complete 2025-26 Fiscal Year Adopted Budget, click here.

EDITOR'S NOTE: This story has been edited to clarify the reason for a $1.5 million General Fund Expenditure and update the expected Contingency Reserve amount with new estimates.

Comments ()